Display-TAN

Display-TAN

Display-TAN Mobile Banking: Secure and Mobile

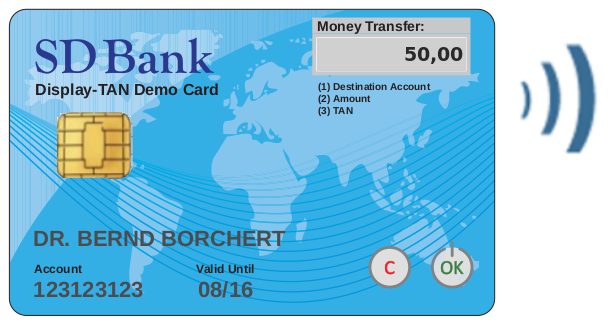

Display-TAN is a TAN-generator integrated into the bank card, including display and Bluetooth

Display-TAN is a Mobile Banking method which is secure and mobile at the same time:

• Display-TAN is secure because the TAN (Transaction Authentication Number) is generated on the bank card - not on the smartphone!

• Display-TAN is mobile in the sense that for Mobile Banking the customer doesn't need more than what he carries anyway: smartphone and bank card.

Moreover, Display-TAN is convenient because Display-TAN requires no typing - just clicking!

Motivation/Background: Why Display-TAN?

Nowadays many financial transactions are executed from the user's smartphone only. But the user's smartphone may be infected by malware. The malware may manipulate transactions because it is able to spy (or abuse) every single one of the user's credentials: password, SMS, secret key, fingerprint, etc.

So the basic idea of Display-TAN is the following: Move out the secret key and the generation of the TAN to the bank card! This way, malware on the smartphone will not be able to manipulate transactions.

And why display and Bluetooth?

- The display is needed for a manipulation-proof revisualization of the transaction data. Without display on the smartcard a trojan on the smartphone would be able to secretly let the smartcard generate a TAN for a different/malicious transaction.

- Bluetooth is needed for the comfortable (and encrypted) transport of the transaction data to the card.

Base Information

Hardware. The main element of the Display-TAN method is a bank card which has a display and a Bluetooth module - and nevertheless is thin, flexible, robust and durable like a usual bank card.

Security. The security of Display-TAN comes from the fact that everything security-critical takes place on the secure card (not on a potentially insecure end device like PC, Laptop, Tablet, Smartphone): (1) The storage of the secret key, (2) the tamper-proof re-visualization of the payment data, and (3) the generation of the TAN. The Bluetooth connection is fully encrypted.

Usability. The bank customer does not need an extra TAN-generator device. This is especially useful in the case of Mobile Banking because the customer does not need anything more than what he carries anyway: smartphone and bank card. Moreover, the bank customer does not need to type anything - just checking and clicking is enough. Even long account numbers like IBAN can be confirmed conveniently with a few clicks.

Online Payment. With the rise of Sofort, Trustly, etc., more and more Internet payments are nowadays executed as money transfers. This way, Display-TAN automatically becomes an Internet Payment method. Display-TAN is much more secure than PayPal or credit cards but nevertheless is of nearly comparable usability (no extra device, no typing besides username/password).

No Pairing. There is no pairing with the smartphone. This is possible because all the security is done completely on the card, not on the smartphone. This way, the customer is not bound to a specific mobile device, i.e. he is able to use several mobile devices alternatingly for Mobile Banking, and may add a new one at any time.

Base Information about the Card

Form. Thin and flexible like a usual bank card (ISO/IEC 7810).

Lifetime. 5 years and 2000 money transfers.

Durability. The card producer has for its display cards a proven ≤ 1% failure rate over the whole card lifetime.

Availability. Technically ready (Bluetooth certification is pending).

How does it work?

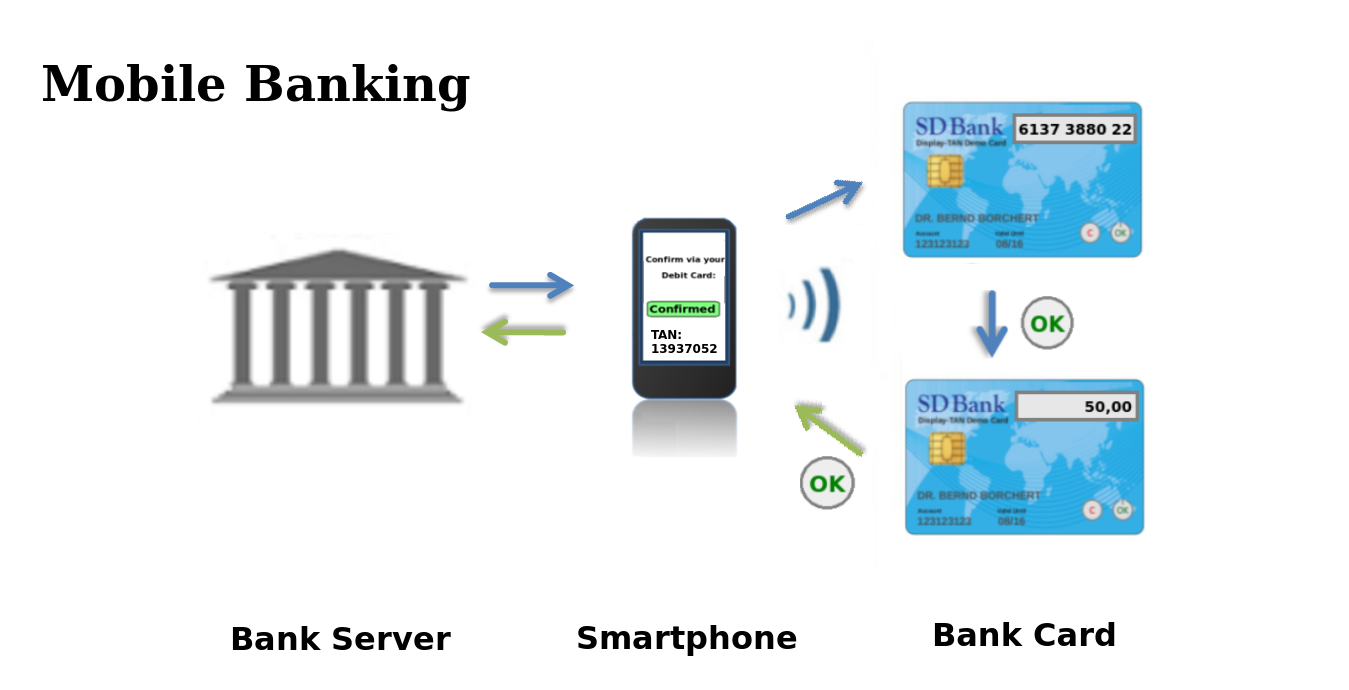

Mobile Banking. The new method is shown in the video above, and is in the image below shown from a user's perspective for Mobile Banking - for which is Display-TAN is suited especially well.

Note that the bank customer does not have to type anything during TAN generation - just checking and clicking is enough.

For more workflows like Online Banking and Payment see the Workflow page.

Uniqueness of Display-TAN

Display-TAN is the first and only Mobile Banking method which is trojan-secure and mobile!

- Every other Mobile Banking method which is trojan-secure (TAN-Generator, Flickering code method, ...), is not mobile because the customer has to carry an extra device.

- Every other Mobile Banking method which is mobile (SMS-TAN, App-generated TAN, NFC-TAN, biometric methods, SIM-card/SE based methods), is not trojan-secure because a smartphone trojan which has infiltrated the Operating System of the smartphone is able to execute a fraudulent money transfer without the customer or the bank noticing it, see for example this contribution for a description of the respective attacks.

For the same reasons, Display-TAN is the only Mobile Banking method which is at the same time mobile and secure against friendly fraud.

IBAN (Netherlands)

IBAN

The new European IBAN destination bank account numbers can conveniently be confirmed with 3 or 4 clicks by the bank customer, line per line, see example to the right and the IBAN page.

More Information

For more details concerning the Display-TAN method see the More Information page, covering topics like Security, Usability, Integration of Display-TAN into the bank card, Buttons on the Card, Display-TAN as a successor of NFC-TAN, TAN-generating algorithm.

For a comparison of Display-TAN with Smartphone-TAN (= App-TAN) in terms of security/usability/costs see this extra page.

Requirement for the User Device: Bluetooth Smart (BLE)

Basically, all smartphone and tablet models since 2013 do have the necessary Bluetooth version Bluetooth Smart also called Bluetooth Low Energy BLE: iPhone 4s or higher, iPad 3 or higher, Android 4.3 or higher. Many PC's and most Laptops have BLE ability, so they may contact the Display-TAN card directly.

Why Bluetooth and not NFC?

iPhone/iPads. The main reason to prefer Bluetooth (BLE) over NFC is that this way also iPhones and iPads are reached.

Stability. Bluetooth is much more convenient and stable concerning the card handling than NFC: With NFC the card has to be hold adjacent to the smartphone, while with Bluetooth the distance may be up to a meter, and moving the card or the smartphone is no problem.

Security. All data sent via Bluetooth to the card are encrypted by the bank server with the individual secret key of the card, i.e. sniffing or manipulating is not possible.

30. August 2017. Netknights/Koelbel: Securing Bank Transactions

30. August 2017. Netknights/Koelbel: Securing Bank Transactions

1. Juni 2017. Fraunhofer SIT, Darmstadt, Workshop Mobile und Embedded Security, Vortragsfolien: Die Sicherheit von Smartphones als IoT Fernsteuerungsgeräte

1. Juni 2017. Fraunhofer SIT, Darmstadt, Workshop Mobile und Embedded Security, Vortragsfolien: Die Sicherheit von Smartphones als IoT Fernsteuerungsgeräte

1. Dez. 2016, Stuttgarter Zeitung: Fintech-Event - Abschnitt über Display-TAN

1. Dez. 2016, Stuttgarter Zeitung: Fintech-Event - Abschnitt über Display-TAN

Older Press

Related News

7. 2. 2019, Vasco Blog: 2 Milliarden Menschen nutzen das Smartphone für Finanztransaktionen

7. 2. 2019, Vasco Blog: 2 Milliarden Menschen nutzen das Smartphone für Finanztransaktionen

23. 11. 2018, NOZ: BSI Chef: Schadprogramme auf jedem Gerät

23. 11. 2018, NOZ: BSI Chef: Schadprogramme auf jedem Gerät

15. 11. 2018, Heise: PSD2 - Was passiert mit unseren Bankkonten

15. 11. 2018, Heise: PSD2 - Was passiert mit unseren Bankkonten

6. 9. 2018, Computerwoche: Voice/Video Kloning als Gefahr für biometrische Lösungen

6. 9. 2018, Computerwoche: Voice/Video Kloning als Gefahr für biometrische Lösungen

19. 6. 2018, Mennes/Vasco, IT-Finanzmagazin: PSD2/RTS Definition SEE

19. 6. 2018, Mennes/Vasco, IT-Finanzmagazin: PSD2/RTS Definition SEE

12. 4. 2018, IT-Finanzmagazin: Vorbehalte mobiles Bezahlen

12. 4. 2018, IT-Finanzmagazin: Vorbehalte mobiles Bezahlen

8. 4. 2018, IT-Finanzmagazin: FaceID für Online Banking

8. 4. 2018, IT-Finanzmagazin: FaceID für Online Banking

29. 3. 2018, Vasco Blog: PSD2 - Dynamic Linking

29. 3. 2018, Vasco Blog: PSD2 - Dynamic Linking

9. 2. 2018, Handelsblatt: Amazon stoppt Kontozugriff per Alexa

9. 2. 2018, Handelsblatt: Amazon stoppt Kontozugriff per Alexa

29. 1. 2018, Security Intelligence: Consumer Study Authentication

29. 1. 2018, Security Intelligence: Consumer Study Authentication

8. 1. 2018, Focus Online: PDS2

8. 1. 2018, Focus Online: PDS2

29. 12. 2017, RT: ,

29. 12. 2017, RT: ,

28. 12. 2017, Heise/CCC/Haupert: Aushebeln der Härtungs-Software für Banking Apps, Interview netzpolitik.org, Video CCC Vortrag

28. 12. 2017, Heise/CCC/Haupert: Aushebeln der Härtungs-Software für Banking Apps, Interview netzpolitik.org, Video CCC Vortrag

7. 12. 2017, Trustonic, R. Dyke: Unwrapping PSD2 RTS

7. 12. 2017, Trustonic, R. Dyke: Unwrapping PSD2 RTS

14. 12. 2017, Samsung: Device-side Security: Samsung Pay, TrustZone, and the TEE

14. 12. 2017, Samsung: Device-side Security: Samsung Pay, TrustZone, and the TEE

13. 12. 2017, IT-Finanzmagazin: Banking-Sicherheit: Mobile Apps, APIs und die PSD2

13. 12. 2017, IT-Finanzmagazin: Banking-Sicherheit: Mobile Apps, APIs und die PSD2

12. 12. 2017, IT-Finanzmagazin: PSD2: Die finalen RTS – was bedeuten sie für Banken?

12. 12. 2017, IT-Finanzmagazin: PSD2: Die finalen RTS – was bedeuten sie für Banken?

27. 11. 2017, IT-Finanzmagazin: PSD2-RTS zu X2A veröffentlicht

27. 11. 2017, IT-Finanzmagazin: PSD2-RTS zu X2A veröffentlicht

24. 11. 2017, Computerbild: Instant Payment kommt

24. 11. 2017, Computerbild: Instant Payment kommt

23. 11. 2017, Süddeutsche: Online Banking Apps sind anfällig für Hacker (FAZ dazu, Reaktion DK)

23. 11. 2017, Süddeutsche: Online Banking Apps sind anfällig für Hacker (FAZ dazu, Reaktion DK)

20. 11. 2017, Trustonic, R. Dyke: In the Game of Trusts, Verify is the King

20. 11. 2017, Trustonic, R. Dyke: In the Game of Trusts, Verify is the King

17. 11. 2017, HBR: Hackers are targeting your mobile phone

17. 11. 2017, HBR: Hackers are targeting your mobile phone

3. 11. 2017, BILD (Schlagzeile): Neue EU-Richtlinie für Banken - Warum Ihre Kontodaten in höchster Gefahr sind! (Version Computerbild)

3. 11. 2017, BILD (Schlagzeile): Neue EU-Richtlinie für Banken - Warum Ihre Kontodaten in höchster Gefahr sind! (Version Computerbild)

22. 10. 2017, GS1: Mobile-in-Retail Studie

22. 10. 2017, GS1: Mobile-in-Retail Studie

17. 10. 2017, IT-Finanzmagazin/BSI: BSI rät von WLAN Nutzung beim Online Banking ab

17. 10. 2017, IT-Finanzmagazin/BSI: BSI rät von WLAN Nutzung beim Online Banking ab

Older News

Polls 2017: For a majority of Germans, Mobile Banking is too insecure

17. 10. 2017, GFT Technologies (56% Ablehnung, Seite 12): Mobile Payment Marktanalyse 2017

17. 10. 2017, GFT Technologies (56% Ablehnung, Seite 12): Mobile Payment Marktanalyse 2017

26. 9. 2017, VISA (59% Ablehnung): Studie Digitales Bezahlen

26. 9. 2017, VISA (59% Ablehnung): Studie Digitales Bezahlen

31. 5. 2017, ING-Diba (68% Ablehnung, Seite 4): Die Vertrauensfrage

31. 5. 2017, ING-Diba (68% Ablehnung, Seite 4): Die Vertrauensfrage

Display-TAN Apps

Apps. Demo Apps for Display-TAN are available for

- Android

- iOS

- Windows

SDK. Libraries/SDKs for the core functionality of Display-TAN are available for Android, iOS, and Windows.

Display-TAN Project

Display-TAN is a joint project of

- SmartDisplayer Inc., Taiwan,

- Tübingen University, Germany,

- Borchert IT-Sicherheit UG.

Coming Events

- Trustech, Cannes, Nov. 27-29, 2018, Booth K-020, Hall Riviera

- Omnisecure, Berlin, Jan. 21-23, 2019

More Information

Flyer, transparencies, articles, etc.:

-

Flyer Display-TAN

Flyer Display-TAN -

Flyer Display-TAN

Flyer Display-TAN -

kreditkarte.net, Jan. 2016:: Das Display-TAN-Verfahren: Sicher und bequem zugleich

kreditkarte.net, Jan. 2016:: Das Display-TAN-Verfahren: Sicher und bequem zugleich

-

Cards Karten Cartes, Mai 2016: Display-TAN: Die Bankkarte als TAN-Generator

Cards Karten Cartes, Mai 2016: Display-TAN: Die Bankkarte als TAN-Generator -

Vortrag (20 min), van den Berg Forum, März 2017: Mobile Banking Sicherheit

Vortrag (20 min), van den Berg Forum, März 2017: Mobile Banking Sicherheit -

Vortrag (20 min), Fraunhofer SIT Darmstadt, Mai 2017: Die Sicherheit von Smartphones als Fernsteuerungsgeräte für IoT Devices

Vortrag (20 min), Fraunhofer SIT Darmstadt, Mai 2017: Die Sicherheit von Smartphones als Fernsteuerungsgeräte für IoT Devices -

Vortrag (10 min), IT-Security-Pitch Bochum, Oktober 2017: Display-TAN - Secure Mobile Banking

Vortrag (10 min), IT-Security-Pitch Bochum, Oktober 2017: Display-TAN - Secure Mobile Banking